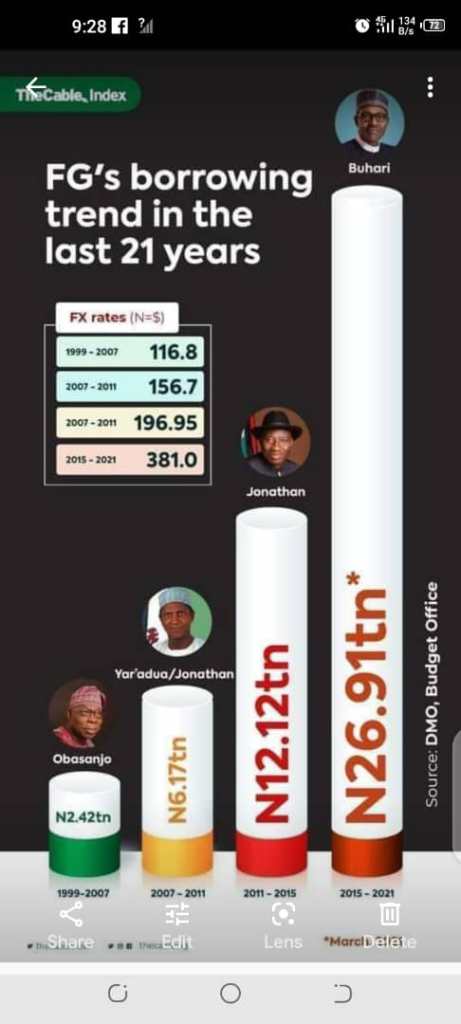

It’s no longer news that Nigeria’s total debt hit #35.5 trillion, this is According to the Director-General of the debt management office (DMO), Patience Oniha, (reference: the Guardian newspaper Sept. 2021)DEBT PROFILE UNDER olusegun obasanjo’S ADMINISTRATION (1999-2007): During the tenure of former president Olusegun Obasanjo, the debt level of the federal government reduced from N3.55 trillion in 1999 to N2.42 trillion at the end of 2007. The 8-year term of Obasanjo resulted in a dip in FG’s local and foreign debt level, representing a 31.8 percent decline. The country’s exchange rate was between N98.02 to N116.8 to a dollar during the tenure. Analysis of the figures showed that external debt decreased from $28.04 billion by 1999 to $2.11 billion at the end of 2007. However, the domestic component increased from N798 billion to N2.17 trillion within the same period. The huge decline in foreign debt was a result of the substantial reduction following the pay-off of the outstanding debts owed to the London Clubs of Creditors in the first quarter of 2007. DEBT PROFILE UNDER yar’adua/jonathan ADMINISTRATION (2007-2011): Under the Umar Musa Yar’Adua/Goodluck Jonathan-led government between 2007 and 2011, domestic debt of the federal government moved from N2.17 trillion to N5.62 trillion. The foreign component of the debt also increased from $2.11 billion to $3.5 billion within the period. The country’s exchange rate also moved from N116.8/$1 to N156.7/$1. The combined debt profile increased from N2.42 trillion to N6.17 trillion in four years, representing a 155 percent jump. Of the debt figure, Jonathan completed the tenure from May 2010 to May 2011 after the death of Yar’Adua. The period saw a surge in the federal government’s debt from N4.94 trillion to N6.17 trillion. This represents a 24.9 percent increase in one year. DEBT PROFILE UNDER JONATHAN’S ADMINISTRATION (2011-2015) At the beginning of former President Goodluck Jonathan’s tenure in 2011, the federal government had an accumulated debt of N6.17 trillion. Analysis of the debt figure showed that local debt amounted to N5.62 trillion while foreign debt stood at $3.5 billion (about N548.65 billion, using the exchange rate of N156.7/$1). DEBT PROFILE UNDER mohamadu buhari ADMINISTRATION (2015-2021): By the end of 2015, the foreign debt component hit $7.3 billion, while domestic debt increased by N8.4 trillion. The country’s exchange rate also stood at N197/$1. Overall, the federal government component of the total public debt increased from N6.17 trillion in 2011 to N9.8 trillion in 2015, representing an increase of N3.63 trillion or 58.8 percent.The Budget Office’s medium-term expenditure framework and fiscal strategy paper from 2015 showed that the Buhari-led administration incurred N7.63 trillion in domestic debt from June 2015 to December 2020.On external borrowings, President Buhari increased debt from $7.3 billion in 2015 to $28.57 billion as of December 2020. This means that the president incurred $21.27 billion on foreign loans to the country’s debt portfolio. The country’s exchange rate moved from N197 to a dollar in 2015 to N381 at the end of December 2020.Analysis of consolidated debt showed that the external debt increased by 291.37 percent while domestic debts grew by 86.31 percent in the last six years of the Buhari government. Overall, the Buhari-led government has had an accumulated debt of N17.06 trillion as of March 2021, using the N381 exchange rate. This represents a 173.2 percent increase from when he was elected president in 2015.NIGERIA’S ACTUAL DEBT COULD BE #35.5 trillion Wilson revenue not improving as expected, creating a wide fiscal deficit that is majorly financed by borrowing.“While borrowing is required to support the economy, especially given the impact of the pandemic, what we need to be concerned about is how sustainable Nigeria’s debt position is,” he said.“Debt has risen N33.1 trillion as of March 2021, an increase of 162.7% in the space of about five years.“ “Debt to GDP may seem quite low at 32 percent, we must understand that debt is serviced with revenues, so if debt servicing is increasing and revenue is not performing, then we have a problem.”Erumebor suggests that the federal government must improve efficiency, transparency, blocking leakages, and deliver value on public projects, despite limited resources.“We must work towards unlocking many sectors and many areas where the country can earn revenue.”In 2020, the International Monetary Fund (IMF) said Nigeria’s low debt-to-GDP ratio is highly vulnerable to shocks.“Despite Nigeria’s relatively low debt level, liquidity-based indicators-driven by low revenue mobilization-remain concerning, with the interest bill representing a high share of government revenue (but low relative to GDP),” IMF said in its country’s report for Nigeria.“Stress scenarios confirm the vulnerability of public debt to a low growth/wide primary deficit scenario. The interest-to-revenue ratio is particularly vulnerable to a real interest rate shock but remains sustainable.”Recently, market researchers at United Capital also expressed concern over the country’s rising debt sustainability risk. “The government has historically justified its rising debt profile by the compliant debt-to-GDP ratio of less than 30.0%,” the research firm said.“However, we reiterate our position that the FG’s debt service cost as a percentage of revenue is a fairer reflection of the country’s debt sustainability position.”At an overall public debt of N35.5 trillion ($89.24 billion), the implication remains that every Nigerian owes both local and foreign organizatio